One Business-Two Prices?

It's all about taxes and depreciation.

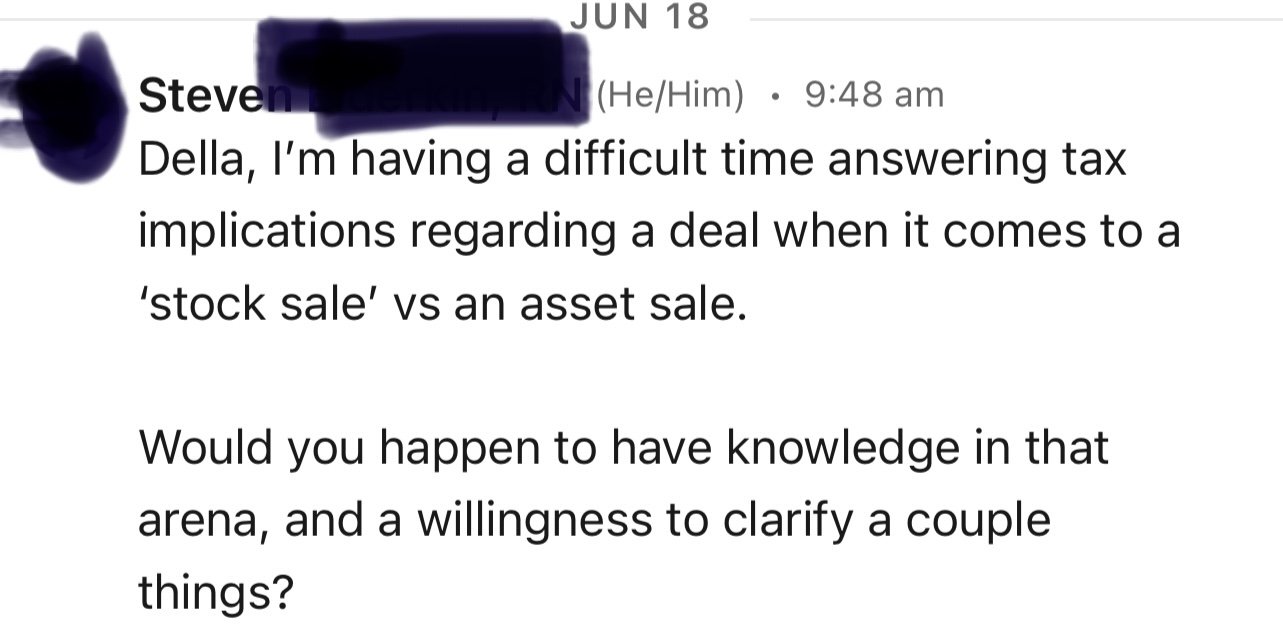

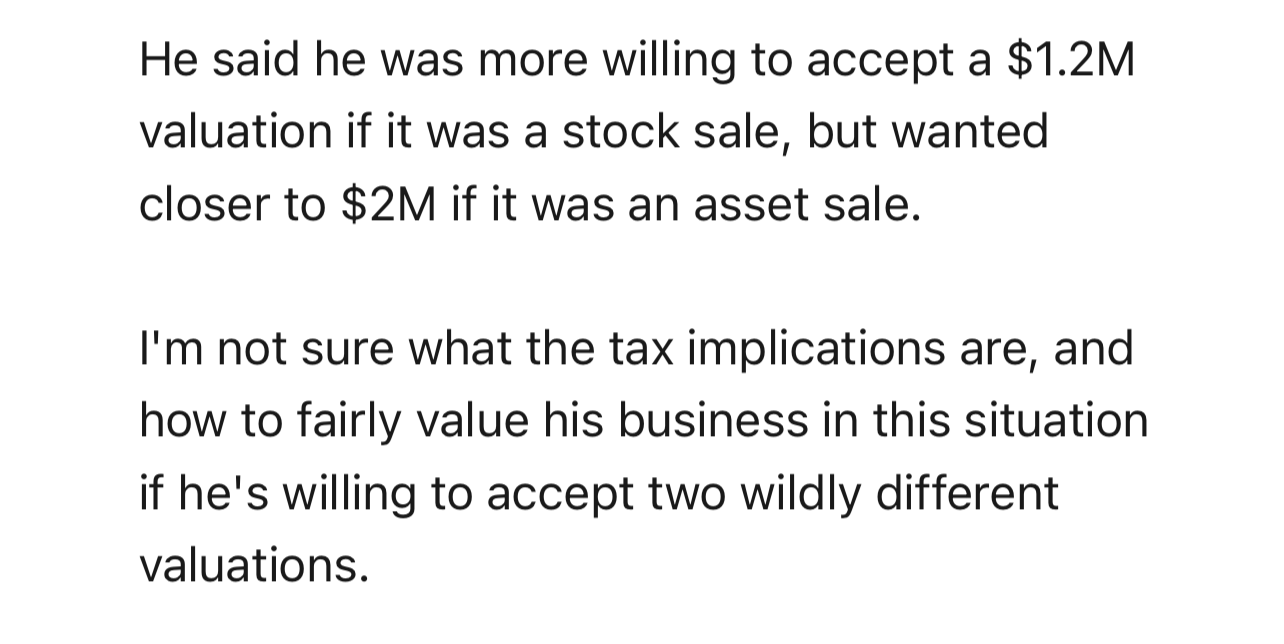

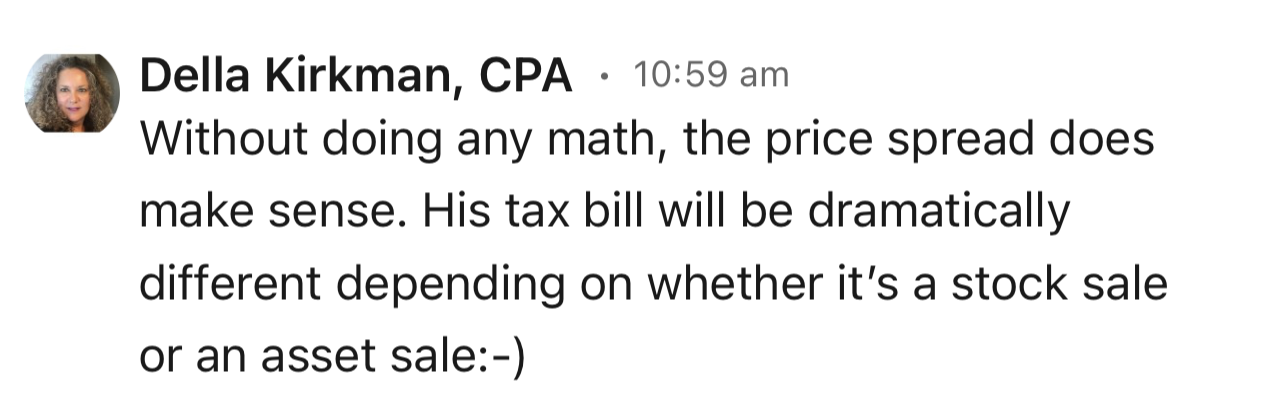

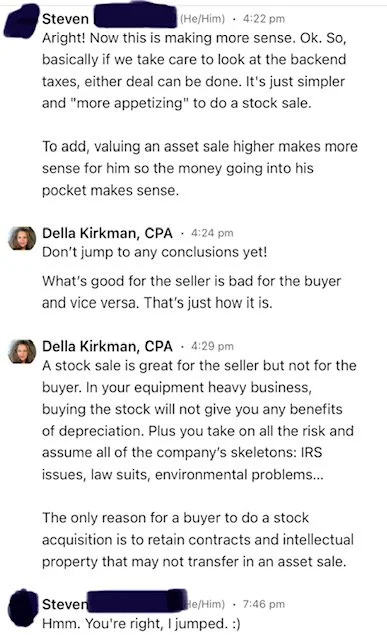

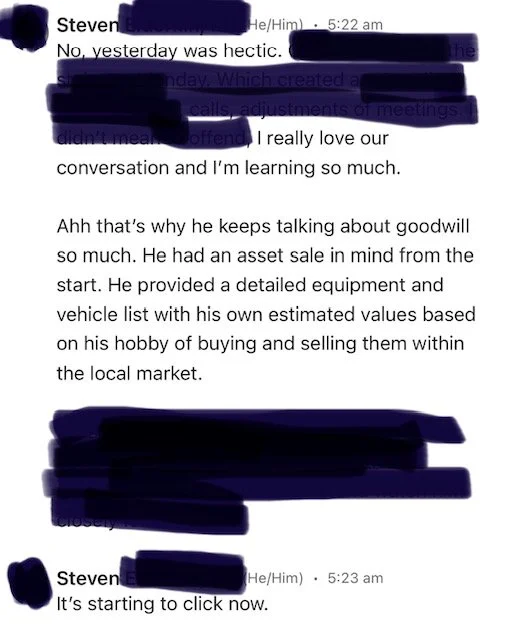

A subscriber reached out to me on LinkedIn recently. (Feel free to do the same😊) I blocked out a few personal items, and his exact identity, but this is what I love!

Steve summarizes the deal:

landscaping business

asset heavy

avg EBITDA $570K

avg profit $425K

(Again, this is over simplified but great for the basic concept)

It's all about taxes and depreciation, two key components of buying and selling businesses. When structuring an acquisition, or a sale for that matter, you must consider the type of deal, the price, and the allocation of that price if it's an asset sale, UPFRONT. Otherwise, you may get a "wildly" unexpected outcome.